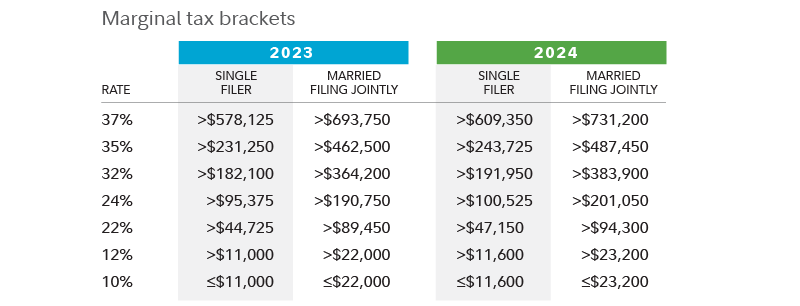

Did The Withholding Tables Change For 2024 – How did this happen? Changes related to The IRS released new withholding brackets reflecting changes to the personal income tax schedule, which employers began using on February 15, 2018. . Only the states of Florida, Alaska, New Hampshire, Nevada, South Dakota, Texas, Wyoming, Washington and Tennessee do not require employers to withhold state income tax from employees’ paychecks. .

Did The Withholding Tables Change For 2024

Source : www.patriotsoftware.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comTax brackets 2024| Planning for tax cuts | Fidelity

Source : www.fidelity.comYour First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comIRS income tax brackets among changes for new year

Source : www.axios.com2024 Tax Changes Affecting Relocation | Standard Mileage | Brackets

Source : www.neirelo.comUpdated Income Tax Withholding Tables for 2024: A Guide

Source : www.patriotsoftware.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comUpdated Income Tax Withholding Tables for 2024: A Guide

Source : www.patriotsoftware.comYour First Look At 2024 Tax Rates: Projected Brackets, Standard

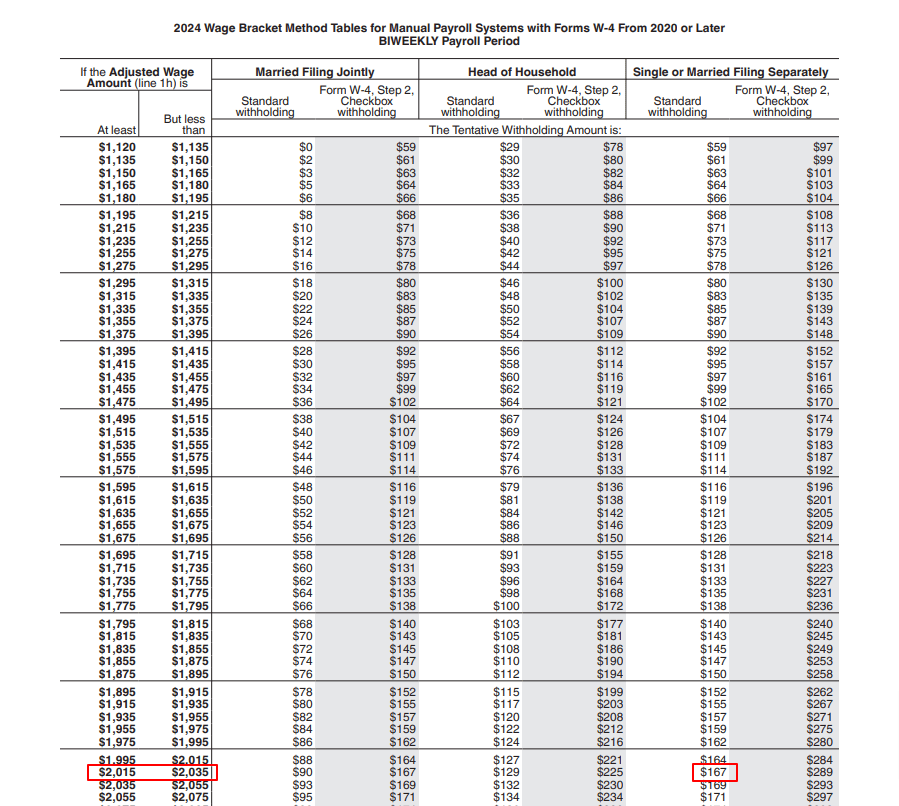

Source : www.forbes.comDid The Withholding Tables Change For 2024 Updated Income Tax Withholding Tables for 2024: A Guide: the formulas and tables used in computing federal income tax withholding are moved from Publication 15 to the new Publication 15-T. Publication 15-T is designed to work with the 2020 Form W-4 (pdf) . This authority by Treasury/IRS to not change withholding tables points to what may be the likely path for taxes: Little to nothing done in lame duck for the reasons mentioned above. However — if .

]]>