Irs Section 179 Vehicle List 2024 – If you purchase assets for your business during the tax vehicle weight rating (GVWR) between 6,001 and 14,000 pounds, and you’re allowed a maximum Section 179 deduction of $30,500 for 2024 . The list of for the EV tax credit shrank in 2024. But experts expect it to grow. Find the current list here. The federal government’s $7,500 tax break for electric vehicle purchases has .

Irs Section 179 Vehicle List 2024

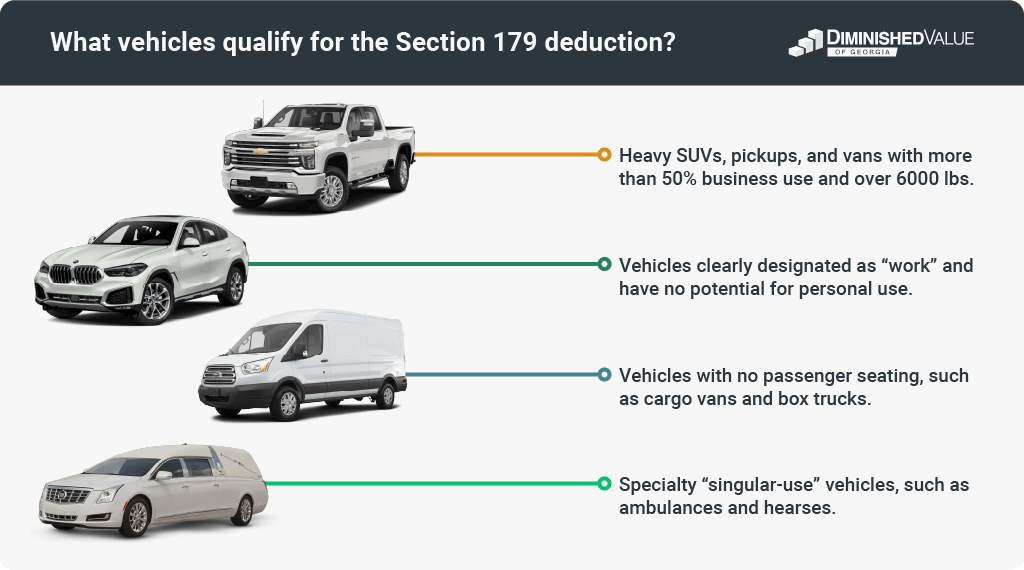

Source : diminishedvalueofgeorgia.comUpdate] Section 179 Deduction Vehicle List 2024 | XOA TAX

Source : www.xoatax.comSection 179 Eligible Vehicles at Bob Moore Auto Group

Source : www.bobmoore.comSection 179 Deduction – Section179.Org

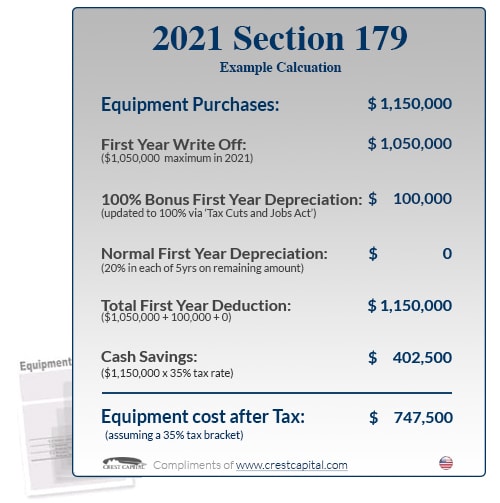

Source : www.section179.orgUpdate] Section 179 Deduction Vehicle List 2024 | XOA TAX

Source : www.xoatax.comSection 179 & Bonus Depreciation Saving w/ Business Tax Deductions

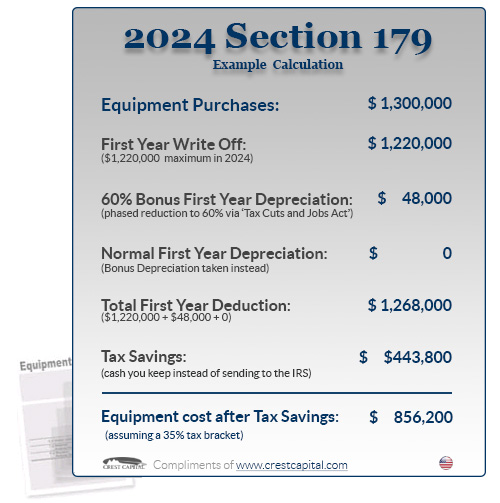

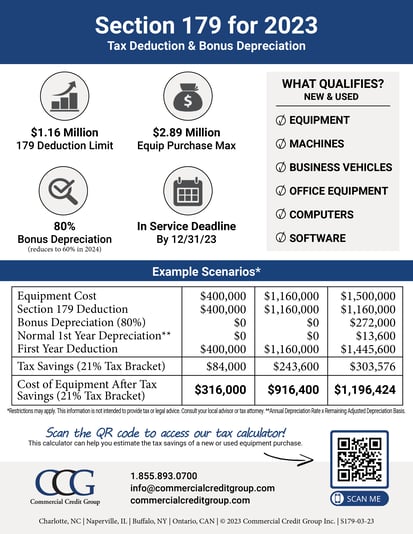

Source : www.commercialcreditgroup.comUnderstanding The Section 179 Deduction Coffman GMC

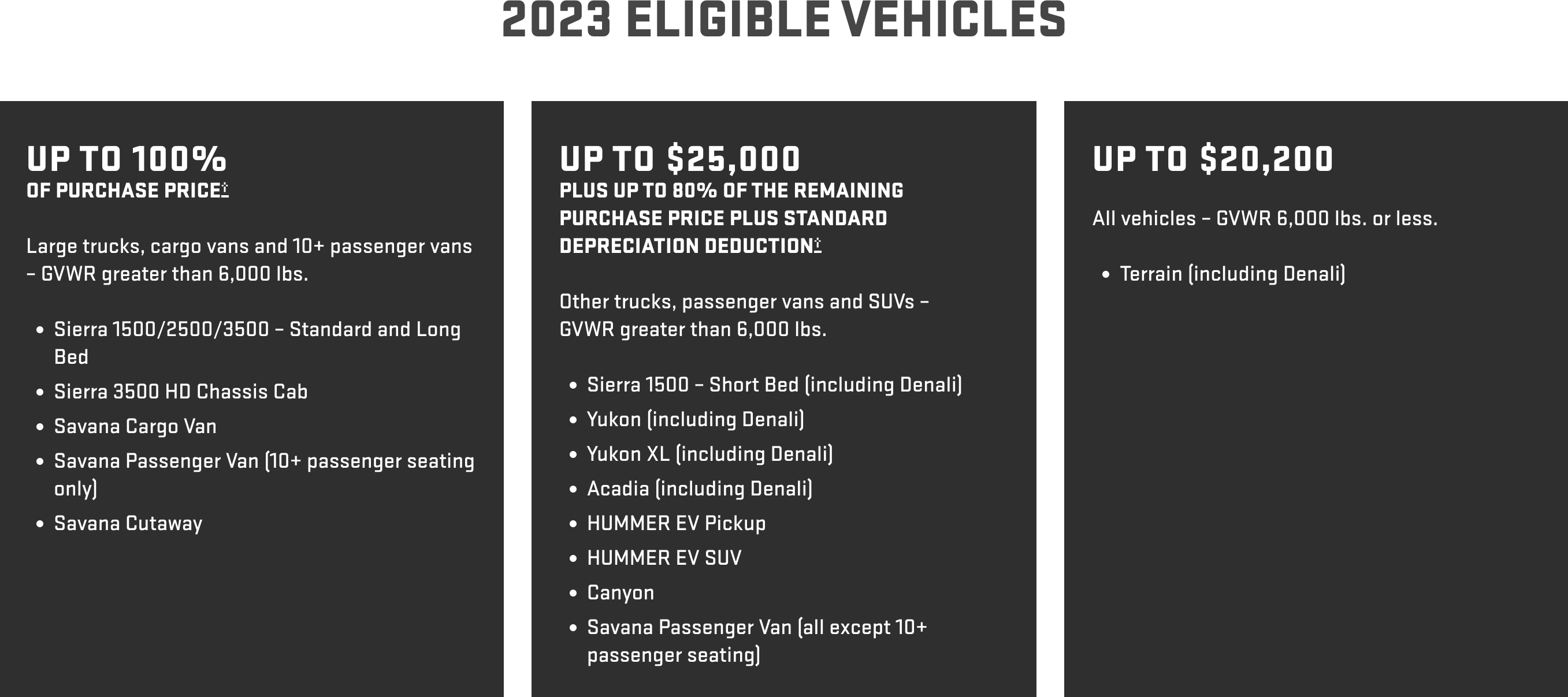

Source : www.coffmangmc.comMaserati Section 179 Deduction for Vehicles | Joe Rizza Maserati

Source : www.joerizzamaserati.comSection 179 Tax Deduction Vehicles List | Bell Ford

Source : www.bellford.comSection 179 Vehicles For 2024 Balboa Capital

Source : www.balboacapital.comIrs Section 179 Vehicle List 2024 List of Vehicles Over 6000 lbs That Qualify for IRS Tax Benefit in : The 2024 electric vehicle Here is a list of our partners and here’s how we make money. People who buy new electric vehicles may be eligible for a tax credit as high as $7,500, and used . Changes to the federal electric vehicle for tax credits if ‘any of the applicable critical minerals contained in the battery’ come from China or other foreign adversaries after 2024 .

]]>